Shopify Seller Accounting: Expert Tips to Simplify Your E-commerce Finances

Table of Contents

Most Read

[fusion_dropcap class="fusion-content-tb-dropcap"]R[/fusion_dropcap]unning a Shopify store is exciting. You’re making sales, gaining new customers, and watching your brand grow day by day. But here’s a reality check: if your accounting is a mess, your business can quickly go off track—no matter how great your sales look.

That’s why having proper accounting for Shopify isn’t just a “nice to have”—it’s a must. Whether you’re just starting your e-commerce journey or you’re scaling fast, managing your finances the right way will save you from tax troubles, cash flow issues, and unnecessary stress.

Let’s break down everything you need to know about Shopify seller accounting—from tools and tips to expert help.

Why Accounting Is So Important for Shopify Seller

Many store owners pour their energy into branding, ads, and product design. But if you don’t know where your money is going—or coming from—you’re flying blind.

Here’s why smart accounting matters:

- You understand your profits (not just sales)

- You stay compliant with taxes like GST or VAT

- You manage inventory and costs better

- You avoid penalties, notices, or cash flow surprises

That’s why having a proper Shopify Seller Accounting strategy is crucial from day one—so your business stays tax-ready and profitable.

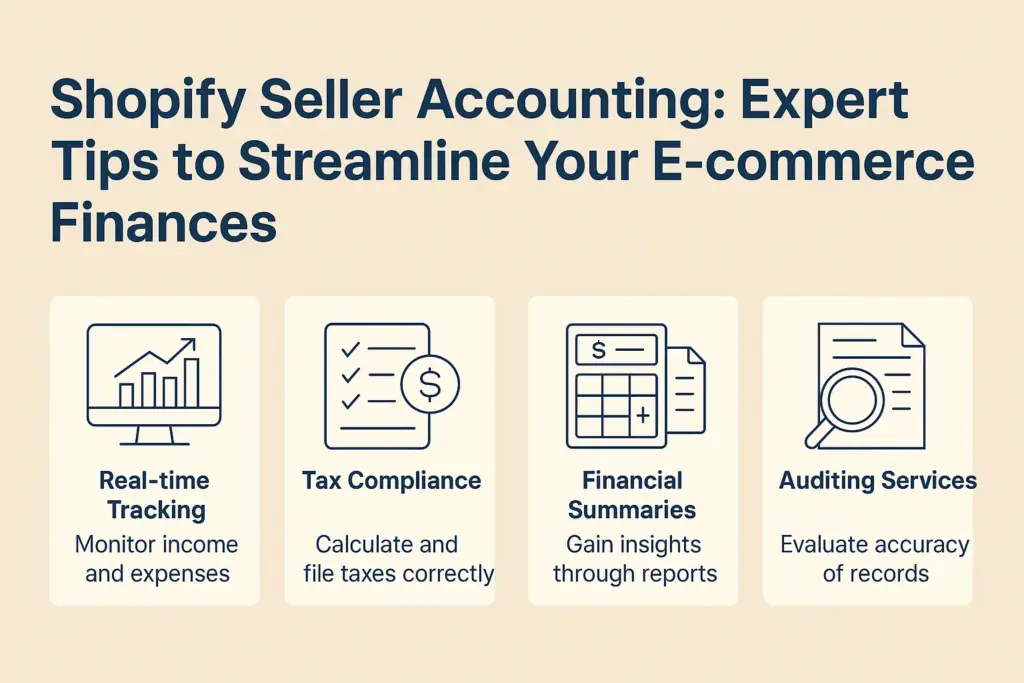

What Does Shopify Accounting Involve?

When you think about e-commerce accounting, you might imagine spreadsheets or software. But it goes way deeper. A good Shopify accounting setup gives you a real-time view of your business health.

Here’s what’s typically involved:

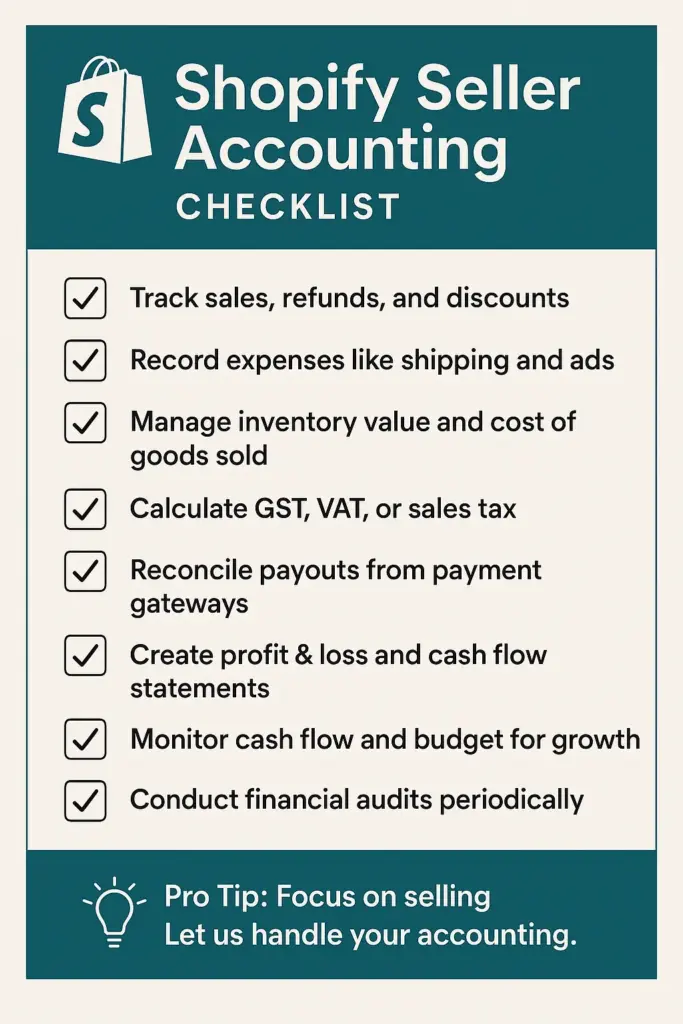

- Tracking sales, refunds, and discounts

- Recording expenses like shipping, advertising, and apps

- Managing inventory value and cost of goods sold (COGS)

- Calculating GST, VAT, or sales tax

- Reconciling payouts from Shopify Payments or Razorpay

- Creating monthly profit & loss and cash flow statements

For Indian sellers, GST returns and Input Tax Credit (ITC) make it even more important to have accurate books. One small mistake can lead to notices from the tax department or blocked credits.

What Do Shopify Bookkeeping Experts Do?

You might be wondering, “Can’t I just use software like Zoho Books or QuickBooks and do it myself?” Technically, yes. But in reality, Shopify sellers deal with lots of moving parts—multiple payment gateways, foreign transactions, returns, inventory, discounts, and taxes.

That’s where Shopify bookkeeping experts come in.

Here’s what they usually handle:

- Syncing Shopify with accounting software (QuickBooks, Xero, Zoho Books)

- Reconciling payments from Razorpay, Stripe, PayPal, etc.

- Tracking refunds, returns, and chargebacks

- Categorizing expenses for accurate reporting

- Handling multi-currency transactions (for international sales)

- Recording shipping and fulfillment costs

This kind of professional support is the backbone of successful Shopify Seller Accounting.

👉 Looking for help with Shopify seller bookkeeping? Check out our Shopify accounting services.

Why Tax Experts Are a Must for Shopify Sellers

Taxes are the trickiest part of running an online store—especially in India. Between GST registration, monthly returns, ITC, and TCS, it’s easy to make mistakes. And the government won’t accept “I didn’t know” as an excuse.

Here’s what a Shopify tax consultant will do for you:

- Set up tax settings in Shopify correctly

- Register you for GST (if not already done)

- File your GSTR-1, GSTR-3B, and other returns on time

- Guide you on Input Tax Credit (ITC)

- Ensure compliance with both central and state rules

- Avoid notices or blocked ITC claims

For example, if you miss filing returns for 2 months, your ITC might get blocked. That’s cash stuck in the system—money you could have reinvested into your store.

The Power of Shopify Seller Accounting Experts

Accounting isn’t just about tracking numbers—it’s about understanding them. When you hire professionals who know Shopify inside-out, you get more than just clean books.

You get business clarity.

Here’s what Shopify accounting experts help with:

- Monthly reports that actually make sense

- Profit analysis by product or category

- Tracking ad spends and returns from each platform

- Monitoring cash flow so you never run out of funds

- Budgeting and forecasting for future growth

- Inventory valuation and shrinkage control

With this level of insight, you’ll know what’s working, what’s wasting money, and where to focus your efforts.

Why You Shouldn’t Ignore Financial Auditing for Your Store

A lot of sellers think auditing is just for big companies. But even small Shopify stores can benefit from regular financial reviews.

Here’s what a financial audit can uncover:

- Incorrect order data or double entries

- Overstated inventory or miscalculated COGS

- Unclaimed GST credits

- Hidden losses you didn’t notice

- Compliance gaps that could trigger notices

Financial audits are like a health check-up for your business. Even if everything’s going smoothly, it’s smart to catch small issues before they become big problems.

Software Tools That Make Shopify Accounting Easier

There are some great tools out there that integrate directly with Shopify. Here are a few we recommend:

🔹 Zoho Books

- Best for Indian sellers

- Strong GST support

- Seamless Razorpay and Shopify sync

🔹 QuickBooks Online

- Great for U.S. and global sellers

- Good reporting features

- Smooth bank feeds and inventory tracking

🔹 Xero

- Clean interface and automation

- Good for multi-currency businesses

- Ideal for medium to large sellers

Each of these tools can simplify your Shopify Seller Accounting when integrated the right way.

Can You Do It Yourself?

Yes, you can manage your accounting on your own. But here’s the thing—do you want to?

DIY accounting often leads to:

- Time wasted on data entry

- Missed tax deadlines

- Wrong ITC claims

- Inaccurate reports

And worst of all? You’re stuck in spreadsheets instead of scaling your store.

Outsourcing your accounting lets you focus on growth, while experts handle the backend.

Final Thoughts: Let Experts Handle the Numbers

Running a successful Shopify store is about more than sales—it’s about building a strong, sustainable business. That means staying on top of your numbers, taxes, and financial reports.

Whether you’re just starting or already doing high volumes, expert accounting can:

- Save you hours every month

- Protect you from penalties

- Help you grow with confidence

If you’re looking for professional help with Shopify Seller Accounting, GST returns, or financial audits, we’ve got your back.

👉 Visit Accounting24.in to learn more about our e-commerce accounting services tailored for Indian sellers.

FAQs

1. Can I handle Shopify accounting myself?

You can—but it’s time-consuming and risky if you’re unfamiliar with tax laws or bookkeeping tools.

2. What’s the best software for Shopify accounting?

Zoho Books (for Indian sellers), QuickBooks, and Xero are excellent choices.

3. Is GST mandatory for Shopify sellers in India?

Yes. If your revenue crosses ₹20 lakh (₹10 lakh in special states), you must register and file GST returns.

💡 Pro Tip: Focus on selling. Let us handle your accounting. That way, your business grows with zero tax stress.